Are you a business owner or a professional with children struggling with the lack of control over how assets are distributed and afraid that family squabbles and heavy financial burden will occur when you are no longer around?

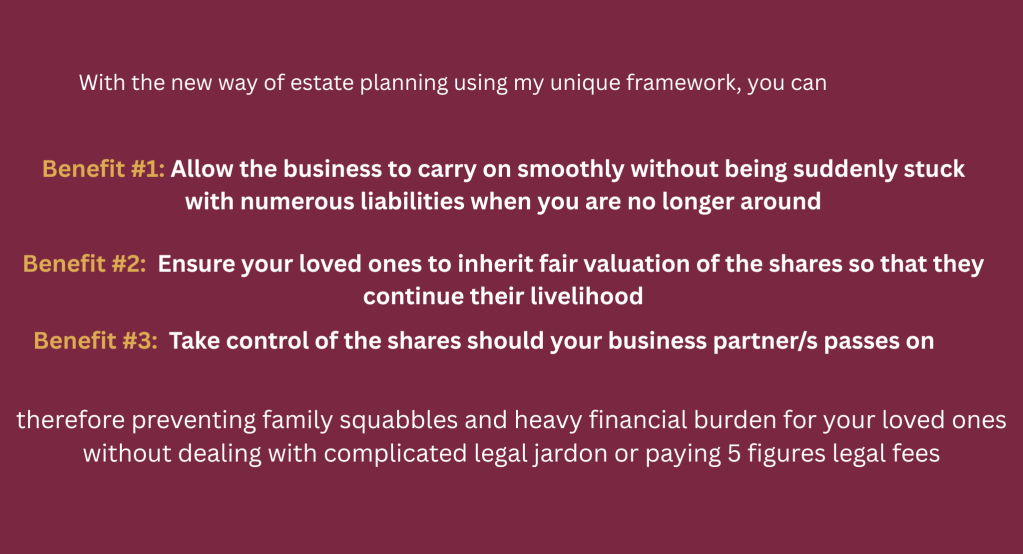

What if I told you that you can prevent family squabbles and heavy financial burden for your loved ones without dealing with complicated legal jargon or paying 5 figures legal fees?

Who am I?

Hi, I’m Amy Lin, and I have been in the financial industry for the past 15 years, with the last 7 years dedicated to estate planning. In that time, I have helped hundreds of professionals and business owners gain greater control and flexibility in distribution assets that will prevent conflict, confusion, and unnecessary costs for their loved ones.

Calling professionals with children

Here’s the thing: many married professionals want to prevent family squabbles and heavy financial burden for their loved ones but face a higher risk of estate disputes among beneficiaries.

It is always in their mind to ensure inheritance to be given equally to their children. One of the most common asset that most will have is their property.

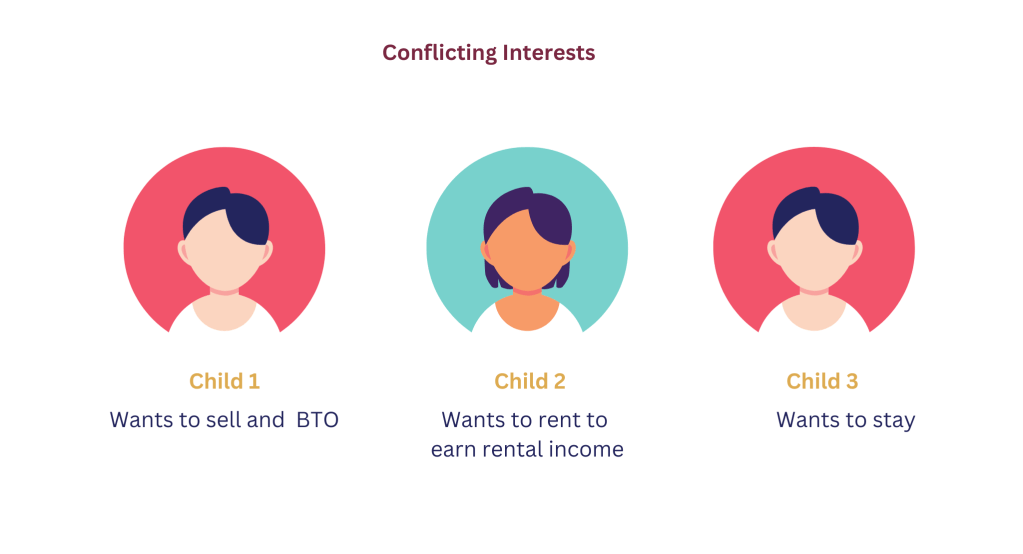

For example, imagine that you have 3 children, and among your assets, you have your property which is a HDB. If you have done a simple will or no will at all, in the event that you and your spouse are no longer around, your children will inherit the HDB.

However, the dispute arises when there is a conflict of interest. The eldest child might want to sell the HDB because he or she is getting married and needs to apply for BTO and cannot do so if his or her name is in the inherited HDB.

The middle child might want to rent out the HDB to get rental income.

The youngest child will want to stay in the property because he or she is still studying and not able to afford a property and needs a roof over his or her head. Neither does the child have the ability to buy over the shares of the other siblings.

In addition, your estate might be quite substantial factoring in insurance payouts, CPF- Central Provident Fund, and properties among cash and investments. It might not be a wise decision to leave such a lump sum to loved ones in case unforeseen circumstances like mental capacity, divorce, bankruptcy, and drug abuse occur. Or they might simply not have the financial literacy to handle large amounts of money or be victims of scams.

But that’s because most professionals do not know how to go about planning and they do not know about a new way of estate planning making use of Wills and Trusts/ Testamentary Trusts to gain better control and flexibility of their assets.

We usually charge $300 per hour for consultation, but I’m only sharing this 1hr complimentary consultation for a limited time because of my limited time having to also service my current clientele.

So if you’re ready to prevent family squabbles and heavy financial burden for your loved ones and gain better control and flexibility of your assets, click on this link to get the offer.

You have no risk because this is a non-obligatory 1-hour complimentary consultation. Once again, all you have to do is click on this link to get the offer.

Calling business owners

Here’s the thing: many business owners might have loved ones who do not wish to take over the business or have no part in the business. Should they pass on, their family might be subjected to unfair terms because they might not have the bargaining power since they do not know the business.

It certainly doesn’t help that when you as a key person/ business owner passes on, the business may have a sudden cashflow problem and may not be able to pay the monies to your family members and dependents.

In addition, many business owners may own the business with other business partners. However, when their business partners are no longer around, they face the situation when their shares are inherited by their business partners’ loved ones like spouses and children who never play a part in the business.

Suddenly, they realise they have to deal with the spouses or children who may be unwilling to sell the shares or have different views about the way the company should run.

We usually charge $300 per hour for consultation, but I’m only sharing this 1-hour complimentary consultation for a limited time only because of my limited time having to also service my current clientele.

So if you’re ready to prevent family squabbles and heavy financial burden for your loved ones and gain better control and flexibility of your assets, click on this link to get the offer.

You have no risk because this is a non-obligatory 1-hour complimentary consultation. Once again, all you have to do is click on this link to get the offer.

WHAT OTHERS SAY…

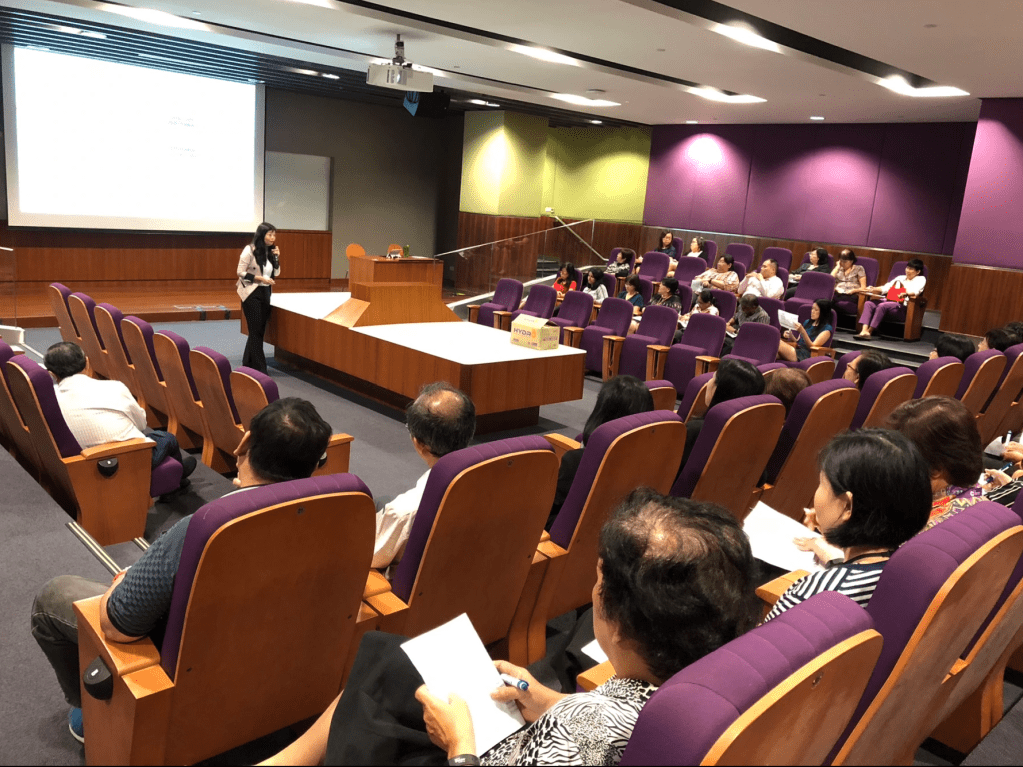

upcoming complimentary seminar

TO BE ADVISED

Contact me

Your message has been sent

subscribe for newsletter

Get updates on Will, Trust & Probate matters and notifications on upcoming free seminars for yourself, friends, and loved ones.